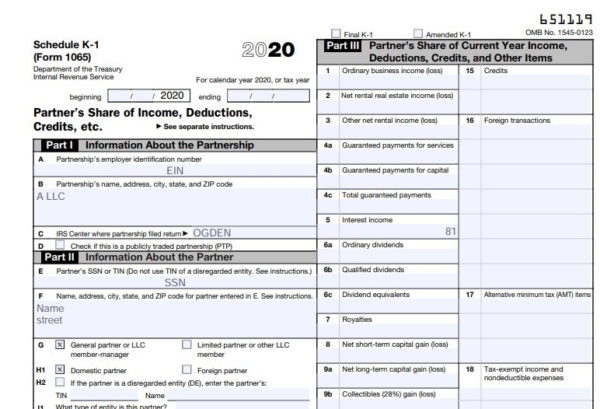

Income Tax Return for an S Corporation, or Form 1065, U.S.

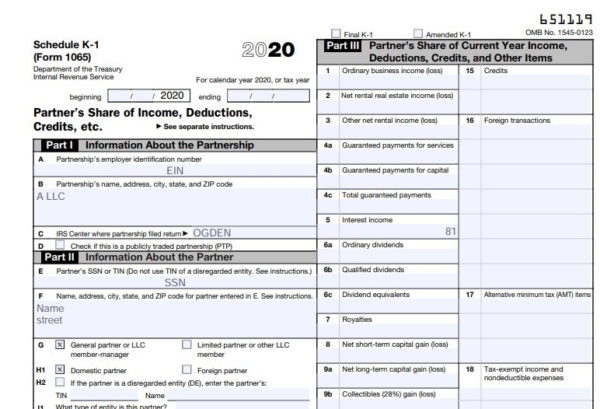

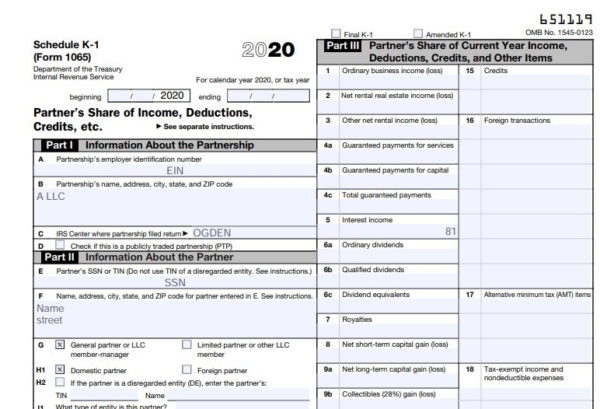

Do I have to attach the federal Form 1120 to my PA-20S/PA-65 return? A complete copy of the federal Form 1120S, U.S. HC, LL OP, LLC As a Limited Liability Company doing business in Pennsylvania, OP, LLC is subject to the Franchise Tax and would be required to file RCT-101 PA Corporate Tax Report. OP, LLC's member is HC, LLC, a multi-member Limited Liability Company formed under the laws of Delaware. OP, LLC is a Single Member Limited Liability Company formed under the laws of Delaware with business activity in Pennsylvania. In cases where the income of a corporate taxpayer is included in the federal income. LLC—Change in Federal Classification Corporate taxpayers are required to file a PA Corporate Tax Report for each federal income tax return they file. Who must file the PA-65 Corp, Directory of Corporate Partners (PA-65 Corp)? A partnership wholly owned by C corporations submits a PA-65 Corp and a complete copy of federal Form 1065, including all federal schedules and federal Form 1065 Schedules K-1. This amount does not have guaranteed payments included because they have already been deducted as an. Instructions for guaranteed payments to partners from federal Form 1065 Line 1 of Schedule M, Part A comes from Line 22 on federal Form 1065 (or Schedule K, Line 1).